Managing finances as a couple is a cornerstone of a healthy relationship. Budgeting together can strengthen trust, improve communication, and help achieve shared goals. However, differing spending habits and financial priorities can make it challenging. This guide offers practical tips to help couples create a harmonious budget that works for both partners.

1. Start with Open Communication

Discuss Financial Histories

Before creating a budget, have an open discussion about your financial background. Share details about income, debts, savings, and spending habits. Transparency builds trust and sets a foundation for collaborative budgeting.

Understand Each Other’s Priorities

Identify individual and shared financial goals. One partner might prioritize saving for a home, while the other values travel. Acknowledge these differences to create a balanced budget.

2. Set Shared Financial Goals

Short-Term Goals

Set immediate goals, such as creating an emergency fund, paying off a specific debt, or saving for a vacation.

Long-Term Goals

Discuss bigger aspirations, such as buying a house, starting a business, or retirement planning. Shared goals help align your financial efforts and motivate consistent budgeting.

3. Choose a Budgeting Method Together

The 50/30/20 Rule

Allocate 50% of your combined income to needs, 30% to wants, and 20% to savings and debt repayment. This simple structure is easy to follow and adaptable.

Zero-Based Budgeting

Assign every dollar of income a purpose, ensuring all money is accounted for, including savings and discretionary spending.

4. Combine Finances Strategically

Decide on Joint vs. Separate Accounts

There’s no one-size-fits-all approach. Some couples prefer joint accounts for shared expenses, while others maintain separate accounts for individual spending. A hybrid model, with both joint and individual accounts, can work well.

Divide Expenses Fairly

Decide how to split expenses based on income or preferences. Some couples opt for a 50/50 split, while others divide expenses proportionally to their earnings.

5. Create a Monthly Budget

Track Income and Expenses

List all sources of income and monthly expenses. Categorize expenses into fixed (rent, utilities) and variable (groceries, entertainment).

Allocate Funds for Fun

Don’t forget to budget for entertainment and hobbies. Allowing room for enjoyment reduces financial stress and helps avoid feelings of deprivation.

6. Schedule Regular Money Dates

Review Your Budget Together

Set a monthly or bi-weekly meeting to review your budget. Discuss what’s working, and what’s not, and adjust as needed.

Celebrate Milestones

Acknowledge financial progress, such as paying off a debt or reaching a savings goal. Celebrating achievements keeps both partners motivated.

7. Plan for Emergencies

Build an Emergency Fund

Set aside funds to cover three to six months of living expenses. Having a safety net reduces financial anxiety and prevents conflict during unexpected situations.

Agree on Emergency Spending

Discuss what qualifies as an emergency to avoid disagreements. For example, urgent car repairs or medical bills may count, but impulsive shopping sprees should not.

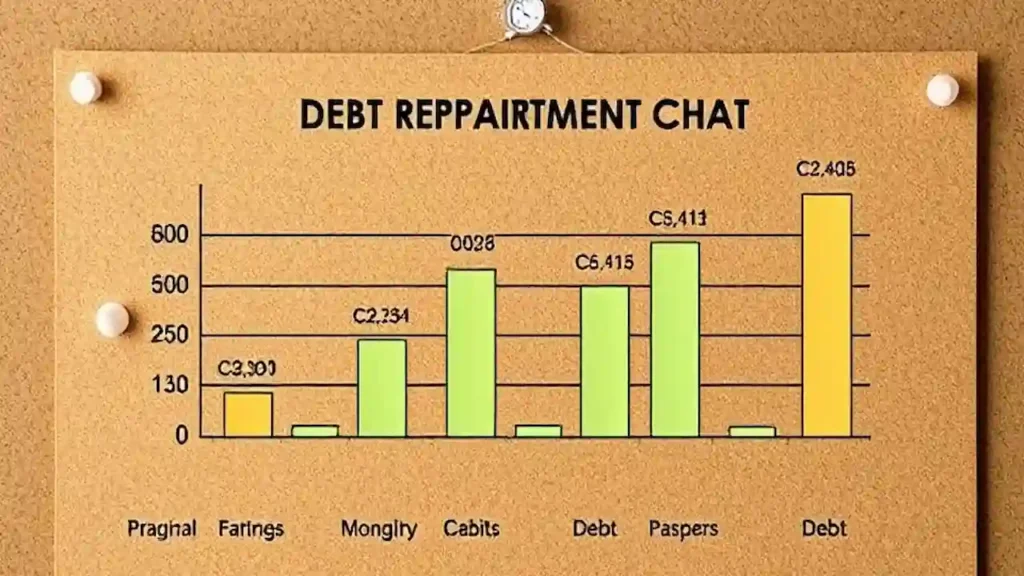

8. Manage Debt Together

Tackle High-Interest Debts First

If one or both partners have debt, prioritize paying off high-interest obligations. Discuss strategies such as the snowball or avalanche method.

Support Each Other

Avoid blaming your partner for past financial decisions. Instead, work together to create a plan to eliminate debt and build a stronger financial future.

9. Set Boundaries for Spending

Agree on Spending Limits

Decide on spending thresholds that require mutual agreement. For example, any purchase over $200 should be discussed beforehand.

Use Discretionary Budgets

Allocate individual discretionary budgets for personal spending. This allows both partners financial freedom while sticking to the overall budget.

10. Address Conflicts Early

Focus on Solutions

Disagreements about money are common, but they don’t have to escalate. Approach conflicts calmly and focus on finding solutions instead of assigning blame.

Seek Professional Help if Needed

If financial conflicts persist, consider consulting a financial advisor or counselor. A neutral third party can provide valuable guidance.

11. Adjust as Life Changes

Life events like career shifts, having children, or relocating can impact your budget. Be prepared to adjust your financial plan as circumstances evolve.

Conclusion

Budgeting as a couple requires teamwork, communication, and flexibility. By sharing financial goals, using effective budgeting methods, and addressing challenges together, couples can achieve financial harmony. Remember, the key is collaboration—your budget should reflect the values and priorities of both partners.

Leave a Reply