Bad credit can feel like a heavy burden, affecting your ability to secure loans, rent a home, or even land a job. However, recovering from bad credit is entirely possible with determination and the right strategies. This guide provides actionable steps to help you rebuild your credit and set yourself on the path to financial stability.

Please log in to upload media.

Understanding What Bad Credit Means

Bad credit typically refers to a credit score below 580 on the FICO scale. It’s often the result of missed payments, high credit utilization, defaults, or bankruptcies. While it may limit your financial options, bad credit isn’t permanent—it’s a condition that can be improved over time.

Assessing the Damage: Review Your Credit Report

1. Obtain Your Credit Report

Start by accessing your credit reports from Equifax, Experian, and TransUnion through AnnualCreditReport.com.

2. Look for Errors

Errors such as incorrect personal details, unfamiliar accounts, or misreported late payments can harm your score.

3. Identify Problem Areas

Pinpoint late payments, high balances, or defaulted accounts that need attention.

Disputing Errors on Your Credit Report

Errors on your credit report can drag your score down unnecessarily.

Steps to Dispute Errors:

- Highlight inaccuracies in your report.

- Contact the credit bureau reporting the error.

- Provide supporting documents to validate your dispute.

- Follow up to ensure the correction is made.

Establishing Better Financial Habits

1. Pay Bills on Time

Set up reminders or automate payments to ensure you never miss a due date. Payment history accounts for 35% of your credit score.

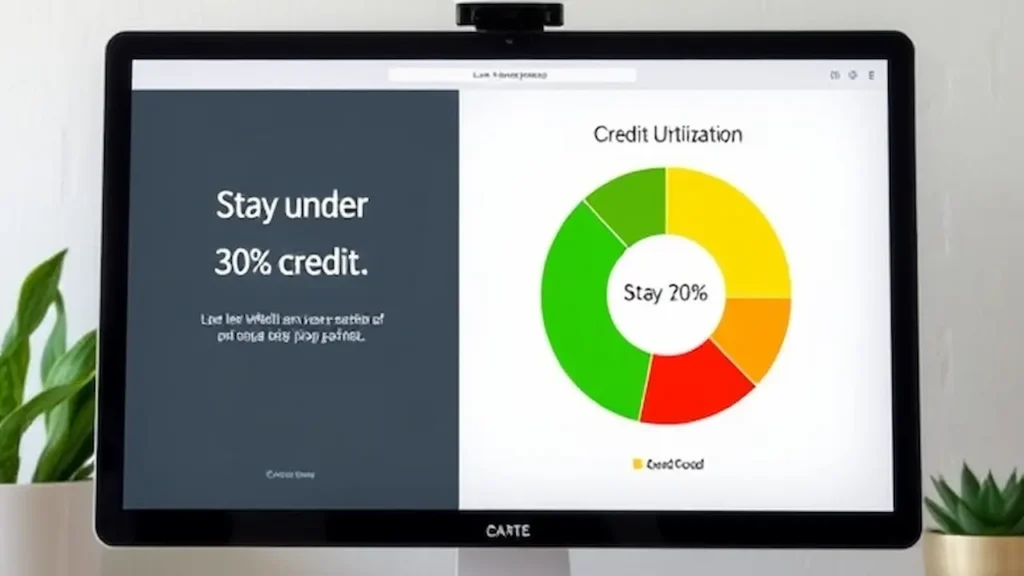

2. Reduce Credit Card Balances

High credit utilization negatively impacts your score. Aim to keep your usage below 30% of your credit limit.

3. Avoid New Debt

Resist the urge to open new credit accounts while working to improve your score.

Prioritizing Debt Repayment

1. Create a Budget

Identify your monthly income and expenses to allocate funds for debt repayment.

2. Use the Snowball or Avalanche Method

- Snowball Method: Pay off smaller debts first to gain momentum.

- Avalanche Method: Focus on high-interest debts to save on interest costs.

3. Negotiate with Creditors

Contact creditors to discuss reduced interest rates or a modified repayment plan.

Consider Credit Counseling

Credit counseling agencies can provide personalized advice to help you manage your finances and recover from bad credit. Ensure you choose a reputable, nonprofit agency.

Building Positive Credit History

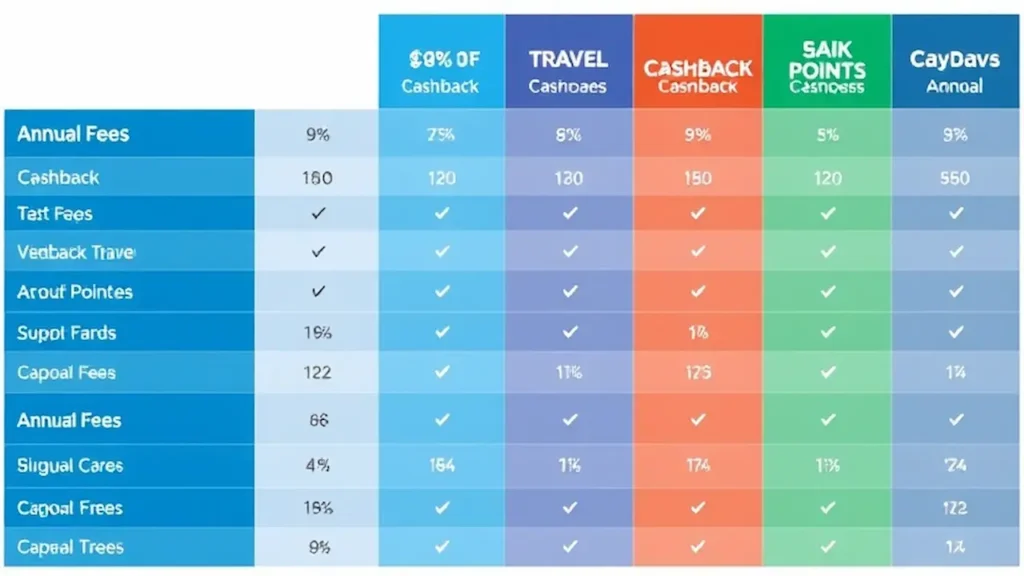

1. Apply for a Secured Credit Card

Secured cards require a deposit and are an excellent way to rebuild credit with responsible use.

2. Become an Authorized User

Ask a family member with good credit to add you as an authorized user on their account.

3. Take Out a Credit-Builder Loan

These loans are specifically designed to help rebuild credit and usually require small monthly payments.

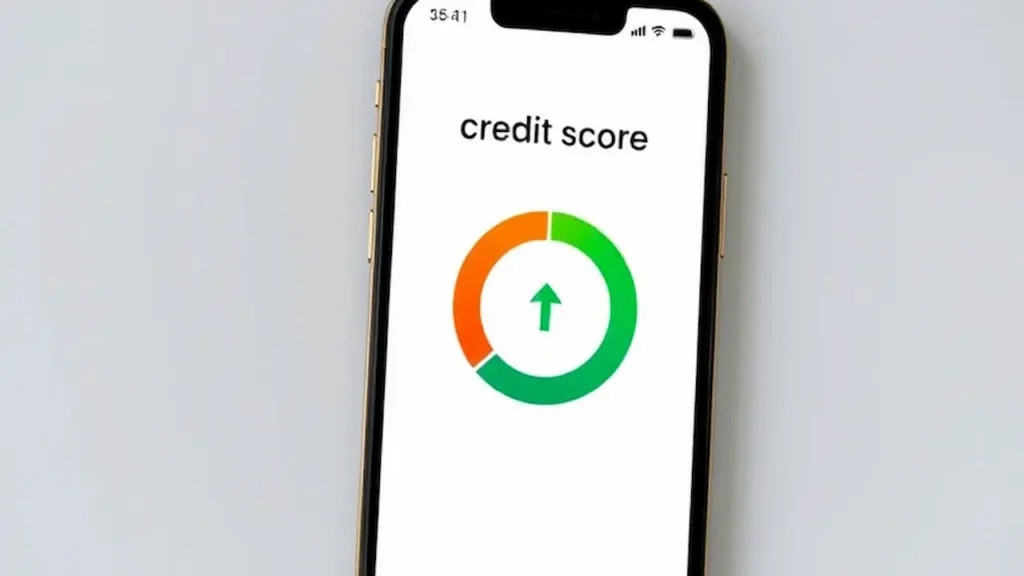

Monitor Your Progress

Track your credit score regularly to see how your efforts are paying off. Many financial institutions and apps offer free credit score tracking.

Protecting Your Credit for the Future

1. Avoid Identity Theft

Secure your personal information and consider using credit monitoring services to detect fraud.

2. Build an Emergency Fund

Having savings for unexpected expenses can prevent you from relying on credit during emergencies.

3. Use Credit Responsibly

Charge only what you can afford to pay off in full each month to maintain a healthy credit utilization ratio.

Overcoming Emotional Barriers

Dealing with bad credit can be emotionally taxing. Remember that financial recovery is a journey, not a race. Seek support from family, friends, or financial counselors to stay motivated.

Conclusion

Recovering from bad credit takes time, discipline, and commitment. By reviewing your credit report, addressing errors, paying off debts, and adopting better financial habits, you can rebuild your credit and start fresh. With consistent effort, achieving a healthy credit score is within your reach, paving the way for greater financial opportunities in the future.