Budgeting is an essential tool for managing finances, but it’s easy to make mistakes that derail your financial goals. From underestimating expenses to failing to track progress, these common errors can prevent you from achieving financial stability. This guide highlights the most frequent budgeting mistakes and provides practical tips to avoid them.

1. Not Tracking Your Expenses

One of the biggest budgeting mistakes is failing to track where your money goes. Without a clear understanding of your spending habits, it’s impossible to create an accurate budget.

How to Avoid It

Use expense-tracking apps like Mint or YNAB, or keep a detailed record of your spending in a notebook or spreadsheet. Categorize expenses to identify patterns and areas where you can cut back.

2. Setting Unrealistic Budgets

Many people create overly restrictive budgets that are impossible to stick to. This can lead to frustration and abandoning the budget altogether.

How to Avoid It

Be realistic about your needs and wants. Allocate funds for both essentials and occasional indulgences. Your budget should be a sustainable plan, not a rigid set of rules.

3. Forgetting to Include Irregular Expenses

Irregular expenses, such as annual subscriptions, car maintenance, or holiday gifts, often get overlooked in budgets, leading to financial strain when they arise.

How to Avoid It

Plan for irregular expenses by creating a sinking fund. Set aside small amounts each month for future needs, so you’re prepared when these costs occur.

4. Ignoring an Emergency Fund

Not having an emergency fund can leave you vulnerable to financial setbacks, such as medical bills or job loss. Without savings, you may have to rely on credit cards or loans.

How to Avoid It

Start building an emergency fund, even if you can only save a small amount each month. Aim for three to six months’ worth of essential expenses.

5. Overlooking Small Expenses

Small, frequent purchases, such as coffee or takeout, can add up significantly over time. These “invisible” expenses can disrupt your budget without you realizing it.

How to Avoid It

Track every expense, no matter how minor. Use apps or journals to monitor these costs and set limits for discretionary spending.

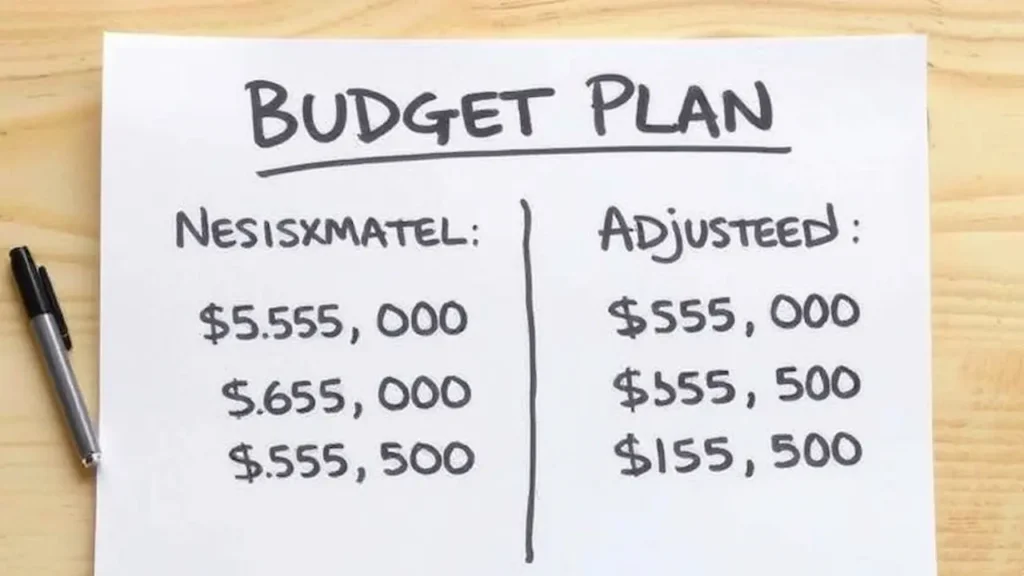

6. Not Adjusting Your Budget

Budgets are not static; they need regular adjustments to reflect changes in income, expenses, or financial goals. Sticking to an outdated budget can lead to overspending or missed opportunities to save.

How to Avoid It

Review and update your budget monthly. Incorporate changes like a raise, new bills, or completed financial goals to ensure your budget stays relevant.

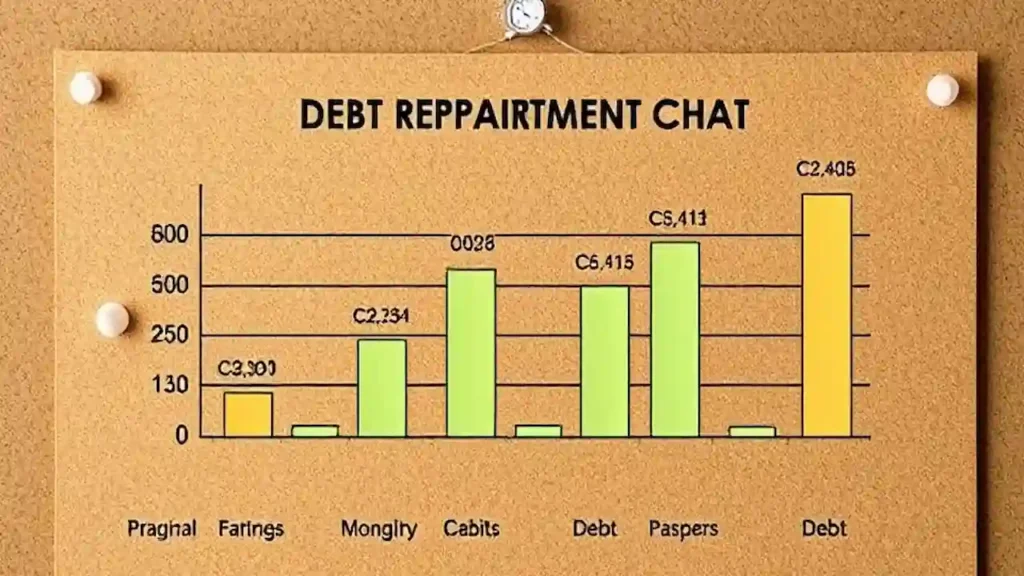

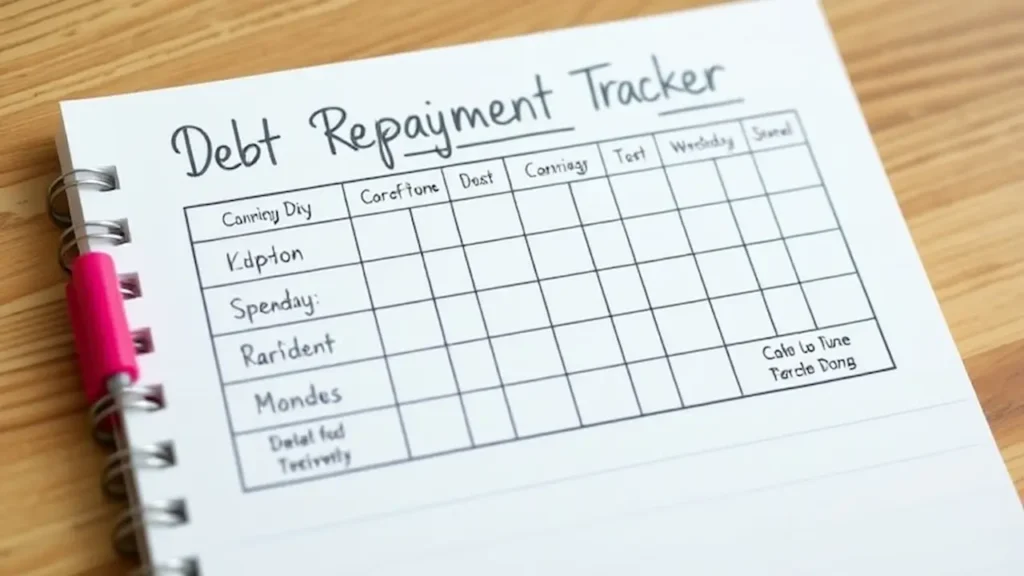

7. Failing to Prioritize Debt Repayment

Ignoring debt or paying only the minimum can extend repayment periods and increase the total interest paid. This mistake slows your progress toward financial freedom.

How to Avoid It

Prioritize debt repayment by using methods like the snowball (smallest balances first) or avalanche (highest interest rates first). Allocate extra funds toward paying off debts as quickly as possible.

8. Not Setting Financial Goals

Without clear financial goals, it’s easy to lose motivation and spend money aimlessly. A lack of direction can make your budget feel pointless.

How to Avoid It

Set short-term and long-term financial goals, such as building savings, paying off debt, or investing. Align your budget with these objectives to stay focused and motivated.

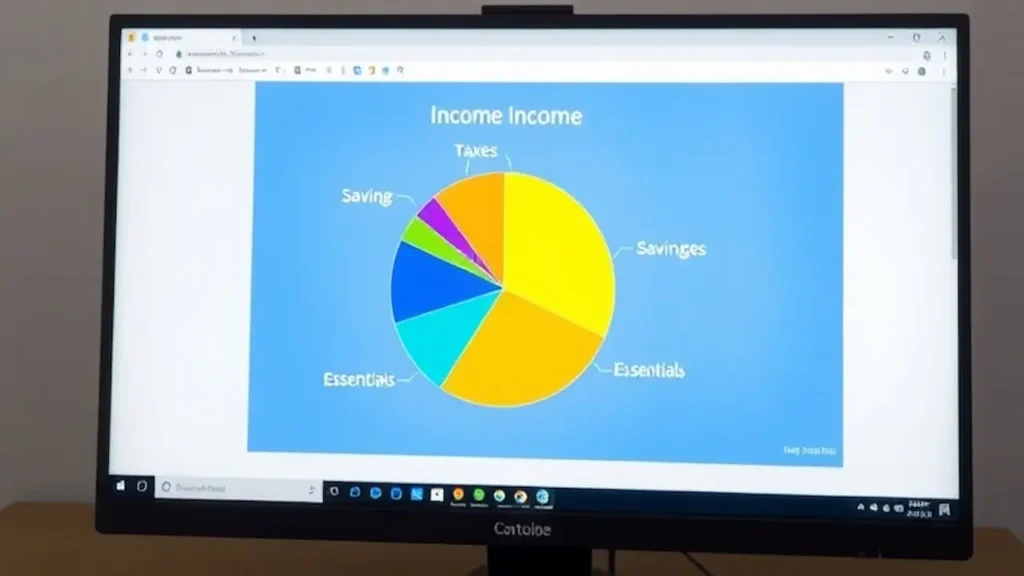

9. Overspending on Non-Essentials

Splurging on non-essential items, like dining out or luxury goods, can quickly derail your budget and reduce the amount available for savings or debt repayment.

How to Avoid It

Stick to spending limits for discretionary categories. Use cash envelopes or prepaid cards to control spending on non-essentials.

10. Relying on Credit Cards

Using credit cards for everyday expenses can lead to overspending and accumulating debt, especially if you’re not paying off the balance in full each month.

How to Avoid It

Use cash or a debit card for everyday purchases to stay within your budget. If you use credit cards, pay off the full balance each month to avoid interest charges.

11. Neglecting Savings

Failing to prioritize savings can leave you unprepared for emergencies or future goals like buying a home or retiring.

How to Avoid It

Pay yourself first by automating contributions to savings accounts before budgeting for other expenses. Even small amounts add up over time.

12. Comparing Your Budget to Others

Every individual’s financial situation is unique. Comparing your budget to others’ can lead to unrealistic expectations or unnecessary spending.

How to Avoid It

Focus on your personal goals and circumstances. Create a budget tailored to your needs and priorities, not someone else’s lifestyle.

Conclusion

Avoiding common budgeting mistakes is key to achieving financial stability and success. By tracking expenses, setting realistic goals, and regularly reviewing your budget, you can create a sustainable financial plan. Remember, budgeting is a journey that requires patience, discipline, and adaptability. Start small, stay consistent, and celebrate your progress along the way.