Credit cards offer enticing rewards like cashback, travel points, and discounts, but they can also lead to debt if not managed carefully. Striking a balance between earning rewards and avoiding credit card debt is a skill that requires discipline and strategic planning. This guide provides actionable tips to help you enjoy the perks of credit card rewards without falling into financial traps.

1. Understand Your Spending Habits

Why It Matters

Before diving into credit card rewards, assess your spending habits. If you’re prone to impulse purchases, using a rewards card might lead to overspending.

How to Do It

- Track your expenses for a month to identify patterns.

- Create a realistic budget that aligns with your income and financial goals.

- Use credit cards only for planned purchases that fit your budget.

2. Pay Off Your Balance in Full Each Month

Why It Matters

Carrying a balance negates the value of rewards because of high interest rates. Paying your bill in full each month helps you avoid interest charges and stay debt-free.

How to Do It

- Set up autopay to ensure timely payments.

- Use your card only for purchases you can afford to pay off immediately.

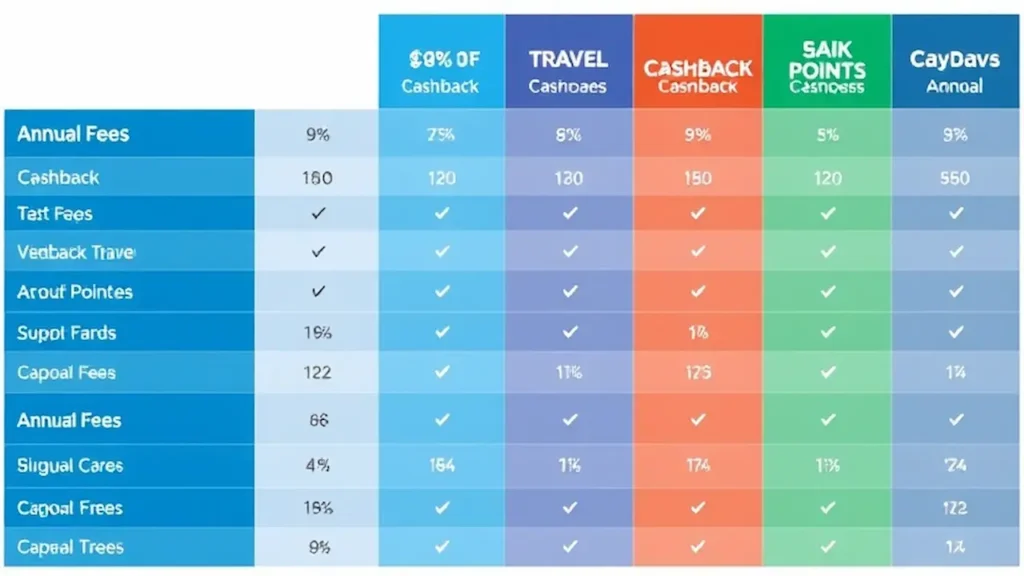

3. Choose the Right Rewards Card

Why It Matters

Not all rewards cards are created equal. Selecting one that matches your spending habits ensures you maximize benefits without added costs.

How to Do It

- Look for cards with no annual fee if you’re a casual spender.

- Match the rewards program to your lifestyle (e.g., cashback for groceries, travel points for frequent flyers).

- Avoid cards with high APRs unless you’re confident in paying off the balance monthly.

4. Avoid Overspending for Rewards

Why It Matters

Rewards programs are designed to encourage spending, but overspending can lead to debt that outweighs the value of rewards earned.

How to Do It

- Stick to your budget and avoid unnecessary purchases, even if they come with extra points or cashback.

- Treat rewards as a bonus, not a reason to spend.

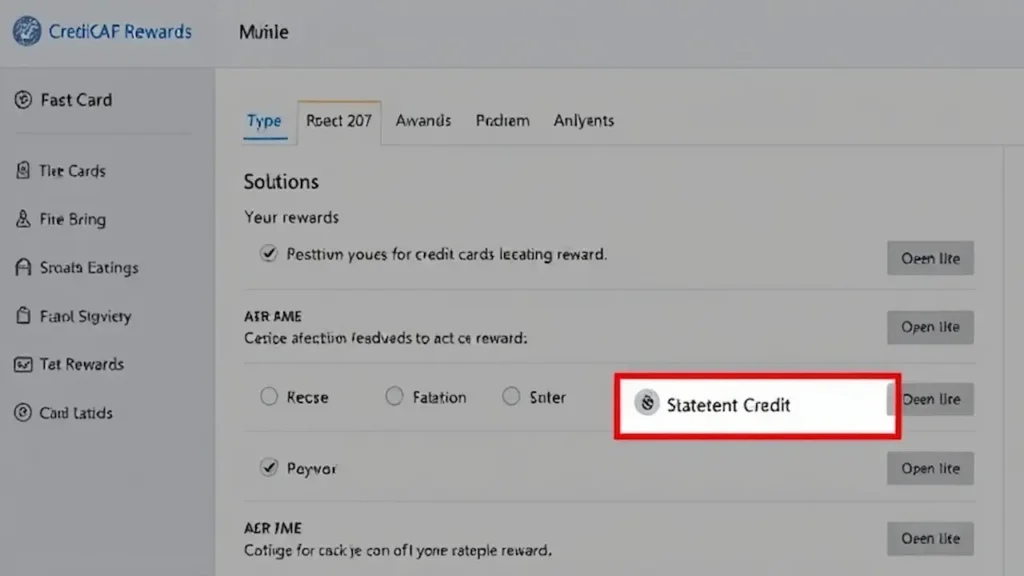

5. Use Rewards Strategically

Why It Matters

Maximizing the value of your rewards ensures you get the most benefit without additional costs.

How to Do It

- Redeem rewards for practical benefits like statement credits or travel discounts.

- Avoid redeeming points for low-value options like gift cards unless necessary.

6. Watch Out for Hidden Fees

Why It Matters

Annual fees, foreign transaction fees, and late payment penalties can eat into the value of your rewards.

How to Do It

- Choose cards with minimal or no fees that align with your spending habits.

- Set reminders to pay on time and avoid penalty fees.

7. Limit the Number of Cards You Use

Why It Matters

Juggling multiple rewards cards increases the risk of missing payments and accumulating debt.

How to Do It

- Start with one or two cards that offer broad benefits.

- Focus on cards that provide rewards for your most frequent expenses.

8. Use Technology to Stay on Track

Why It Matters

Apps and tools can help you monitor your spending and ensure you’re making the most of your rewards while avoiding debt.

How to Do It

- Use personal finance apps like Mint or YNAB to track expenses and balances.

- Enable alerts for approaching due dates or overspending.

9. Redeem Rewards Regularly

Why It Matters

Some rewards expire if not redeemed within a specific timeframe. Regular redemption ensures you get the full value of your rewards.

How to Do It

- Set reminders to check your rewards balance monthly.

- Redeem points or cashback as soon as they reach a useful threshold.

10. Have an Emergency Fund

Why It Matters

An emergency fund reduces the likelihood of relying on credit cards for unexpected expenses, helping you avoid debt.

How to Do It

- Save at least three to six months’ worth of expenses in a high-yield savings account.

- Contribute consistently, even if it’s a small amount each month.

Conclusion

Using credit cards for rewards can be a smart financial strategy if done responsibly. By paying off balances in full, choosing the right card, and sticking to a budget, you can enjoy the perks of rewards without the stress of debt. Stay disciplined, leverage technology, and remember that rewards are a bonus—not a reason to overspend.

Leave a Reply