Freelancers often enjoy the flexibility and freedom of self-employment, but irregular income can make budgeting a challenge. With fluctuating earnings and unpredictable expenses, managing finances requires careful planning and discipline. This guide outlines actionable strategies to help freelancers budget effectively and achieve financial stability.

Why Budgeting Is Crucial for Freelancers

Unlike traditional employees who receive regular paychecks, freelancers experience varying income levels depending on client payments, project availability, and workload. Without a clear financial plan, it’s easy to fall into debt or struggle to meet basic needs during slower months. Budgeting ensures you can cover expenses, save for the future, and reduce financial stress.

1. Calculate Your Average Monthly Income

Track Your Earnings

Review your income over the past six to twelve months to calculate an average. Include payments from clients, side gigs, and any other sources of revenue. If your income varies widely, use the lowest monthly total as a baseline to ensure you’re budgeting conservatively.

Estimate Conservatively

When budgeting, assume your income will be on the lower end of the spectrum. This approach helps you prepare for leaner months and avoid overestimating your financial capacity.

2. Separate Personal and Business Finances

Open Separate Accounts

Maintain dedicated bank accounts for personal and business expenses. This separation simplifies tax preparation, ensures better financial tracking, and prevents overspending.

Track Business Expenses

Keep detailed records of business-related costs like software subscriptions, equipment, and travel. These expenses may be tax-deductible, helping you save money during tax season.

3. Prioritize Fixed and Essential Expenses

Identify Non-Negotiable Costs

List your fixed expenses, such as rent, utilities, insurance, and loan payments. These are your priority bills that must be covered each month, regardless of your income fluctuations.

Create an Essentials Budget

Focus on necessities like groceries, transportation, and healthcare. Categorize these expenses and allocate a portion of your average monthly income to each.

4. Build an Emergency Fund

An emergency fund is vital for freelancers, as it acts as a financial safety net during periods of low income or unexpected expenses.

Start Small and Build Gradually

Aim to save three to six months’ worth of essential expenses. If that feels overwhelming, start by saving enough to cover one month and gradually increase your savings over time.

Automate Savings

Set up an automatic transfer to a high-yield savings account whenever you receive payments. Treat this savings as a non-negotiable expense.

5. Create a Variable Budget

Use a Two-Tier Budgeting System

Develop two budgets: a “bare-bones” version that covers only essential expenses and a “full” budget for months with higher income. This approach provides flexibility while ensuring financial stability during lean periods.

Reassess Monthly

Review your budget at the start of each month to account for changes in income or unexpected expenses. Adjust your spending accordingly.

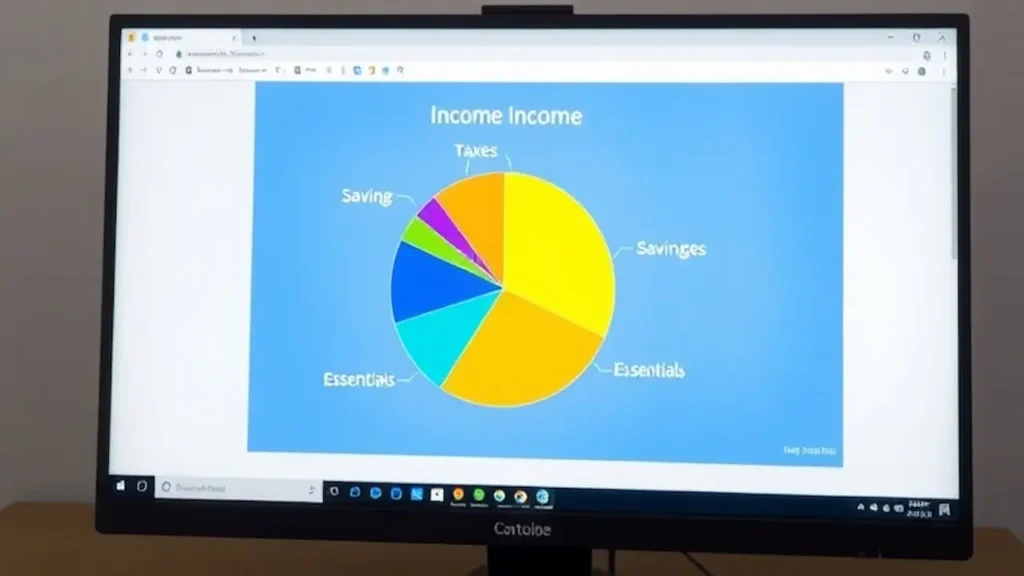

6. Plan for Taxes

As a freelancer, you’re responsible for setting aside money to pay self-employment taxes.

Set Aside a Percentage

Allocate 25-30% of your income for taxes, depending on your location and tax bracket. Use a separate savings account to avoid accidentally spending this money.

Use Tax Software or Professionals

Invest in tax preparation software or consult a professional to ensure accurate filing and to maximize deductions.

7. Manage Irregular Payments Strategically

Smooth Out Income Peaks

During months with higher earnings, resist the temptation to splurge. Instead, allocate extra funds to your emergency savings, tax account, or investment goals.

Use Income Buckets

Divide each payment into buckets, such as essentials, savings, taxes, and discretionary spending. This method ensures all financial priorities are addressed.

8. Minimize Debt

Avoid New Debt

Living within your means is crucial when income is unpredictable. Avoid taking on new debt, and focus on paying down existing obligations to reduce financial stress.

Prioritize High-Interest Debt

If you have multiple debts, tackle the ones with the highest interest rates first. Consider consolidating debts or negotiating with creditors for better terms.

9. Plan for Long-Term Goals

Invest in Retirement

Freelancers don’t have employer-sponsored retirement plans, so it’s essential to save independently. Consider opening an IRA, SEP IRA, or Solo 401(k).

Save for Future Projects

Set aside money for professional growth, such as courses, certifications, or new equipment, to ensure your career remains competitive.

10. Stay Disciplined and Adaptable

Budgeting on irregular income requires discipline and regular adjustments. Be proactive in tracking your finances, learn from your spending habits, and adapt your budget as needed. Small, consistent efforts will lead to greater financial security over time.

Conclusion

Handling irregular income as a freelancer may seem challenging, but with a thoughtful approach to budgeting, you can achieve financial stability and peace of mind. Track your income, prioritize expenses, save for emergencies, and plan for the future. Remember, consistency is key, and every small step brings you closer to financial freedom.

Leave a Reply