Saving $10,000 in a year may seem like a daunting task, but with a clear plan and consistent effort, it’s achievable for many. Whether your goal is to build an emergency fund, pay off debt, or achieve a dream purchase, breaking it down into manageable steps makes the journey less intimidating. This guide will provide practical strategies to help you reach your $10,000 savings goal within 12 months.

1. Break Down Your Goal

Know Your Monthly Target

To save $10,000 in a year, divide the total by 12 months. You’ll need to save approximately $833 per month. Breaking it down further, that’s about $27.40 per day. Having these smaller targets helps keep you focused.

Adjust for Your Income

If $833 per month feels overwhelming, consider extending your timeline or supplementing your income with side hustles.

2. Assess Your Current Financial Situation

Track Your Spending

Before creating a savings plan, track your expenses for at least a month to understand where your money goes. Identify categories where you can cut back.

Eliminate Unnecessary Expenses

Analyze your spending habits and pinpoint areas for reduction, such as dining out, streaming subscriptions, or impulse buys. Redirect these savings into your $10,000 fund.

3. Create a Savings Plan

Set Up a Dedicated Account

Open a separate savings account specifically for your $10,000 goal. Choose an account with no withdrawal penalties and a high interest rate to maximize growth.

Automate Your Savings

Set up an automatic transfer from your checking account to your savings account on payday. Automating this step ensures consistency and reduces the temptation to spend.

4. Cut Expenses Strategically

Downsize Your Lifestyle

Consider downsizing your living arrangements, cooking at home, or using public transport to save money. Small changes in daily habits can lead to significant savings over time.

Embrace the 30-Day Rule

If you’re tempted to make a non-essential purchase, wait 30 days. This practice reduces impulse spending and helps prioritize savings.

5. Increase Your Income

Take on a Side Hustle

Look for additional income opportunities like freelancing, tutoring, or selling handmade crafts. Even an extra $100-$200 per week can make a big difference in reaching your goal.

Sell Unused Items

Declutter your home and sell items you no longer need on platforms like eBay, Facebook Marketplace, or Craigslist.

6. Optimize Your Budget

Use the Zero-Based Budget

Allocate every dollar of your income a specific purpose, ensuring there’s no unaccounted money. Include your savings goal in this plan to prioritize it.

Adopt the Envelope Method

Use cash envelopes for discretionary spending categories like groceries and entertainment. Once the envelope is empty, stop spending for that category.

7. Reduce Debt

Pay Off High-Interest Debt

Focus on reducing or eliminating debts with high interest rates, as they can eat into your potential savings. Consider consolidating debts to lower monthly payments.

Negotiate Lower Rates

Contact creditors or service providers to negotiate lower interest rates or discounts, freeing up more money for savings.

8. Make Smart Lifestyle Changes

Practice Frugality

Find low-cost alternatives to expensive habits. For example, replace gym memberships with outdoor workouts or use free streaming services instead of cable TV.

Find Free Entertainment

Seek out free or low-cost entertainment options, such as community events, public parks, or DIY activities at home.

9. Leverage Windfalls

Save Bonuses and Tax Refunds

If you receive unexpected windfalls, like a work bonus or tax refund, deposit them directly into your savings account instead of spending them.

Participate in Cashback and Rewards Programs

Use cashback apps, rewards credit cards, or loyalty programs to earn additional money or discounts on purchases.

10. Track Your Progress and Stay Motivated

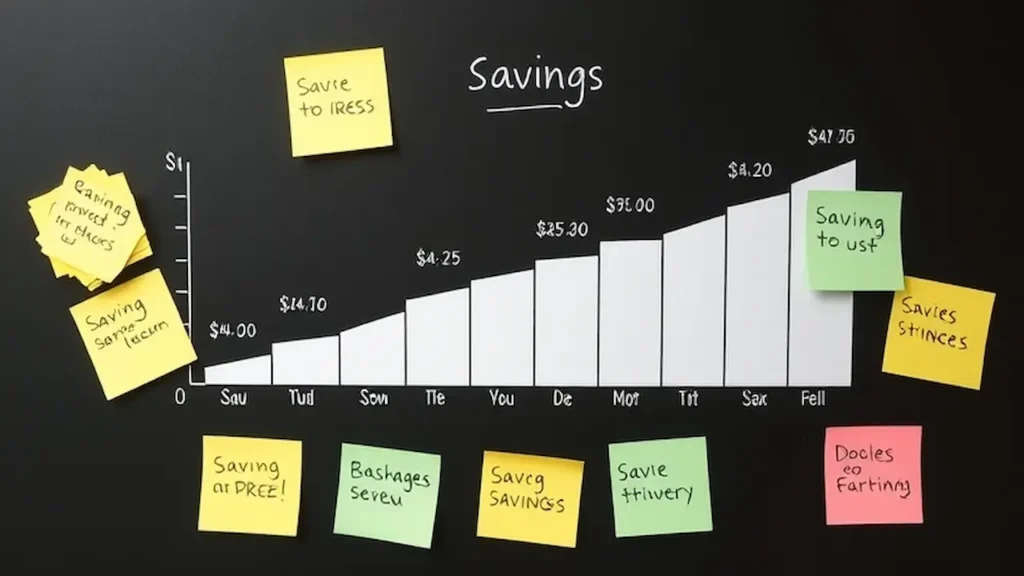

Monitor Your Savings

Regularly check your savings account balance to track your progress. Visual reminders, such as a savings thermometer chart, can help keep you motivated.

Reward Small Milestones

Celebrate smaller achievements, like reaching $2,500 or $5,000. Choose rewards that align with your goals, like a small treat or a no-cost indulgence.

Conclusion

Saving $10,000 in a year is an ambitious but achievable goal with the right mindset and plan. By breaking down your goal, reducing expenses, boosting income, and staying disciplined, you can build a substantial financial cushion. Remember, consistency is key. Start today, and you’ll be amazed at how quickly your savings grow.

Leave a Reply