An emergency fund is a financial safety net that can save you from unexpected expenses like medical bills, car repairs, or job loss. Building one in just six months is ambitious but achievable with the right strategies. This guide will help you plan and execute your savings goal effectively without overwhelming your finances.

1. Determine Your Savings Goal

Calculate Your Expenses

To determine how much you need in your emergency fund, calculate your essential monthly expenses. This includes rent or mortgage, utilities, groceries, insurance, and minimum debt payments.

Set a Target Amount

A general rule is to save 3–6 months’ worth of essential expenses. Since you’re aiming to save in six months, divide your target amount by six to determine your monthly savings goal.

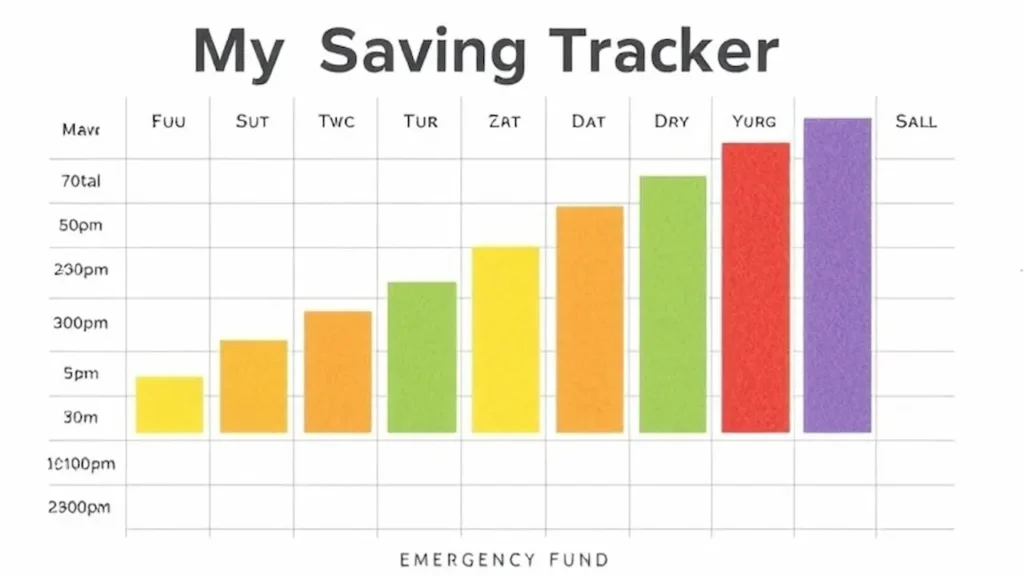

2. Break It Down into Weekly Goals

Divide the Total

Break your monthly savings goal into weekly targets to make it more manageable. Smaller, consistent contributions are less intimidating and easier to track.

Track Progress

Use a savings tracker app or a visual progress chart to monitor weekly contributions. This helps maintain focus and motivation.

3. Adjust Your Budget

Identify Non-Essentials

Examine your current spending habits and identify areas to cut back. This might include eating out, streaming subscriptions, or unnecessary shopping.

Redirect Savings

Every dollar saved from reduced spending should go directly into your emergency fund. Treat this redirection as a fixed expense.

4. Open a Dedicated Savings Account

Separate Your Funds

Open a high-yield savings account exclusively for your emergency fund. Keeping the money separate prevents you from accidentally spending it.

Automate Your Savings

Set up automatic transfers from your main account to your emergency fund after every paycheck. Automation ensures consistency and eliminates the temptation to skip a deposit.

5. Supplement Your Income

Take on a Side Gig

If possible, explore additional income sources like freelancing, selling crafts, or driving for a rideshare service. Direct all extra earnings into your emergency fund.

Sell Unused Items

Declutter your home and sell items you no longer need. Online platforms like eBay or Facebook Marketplace are great for turning clutter into cash.

6. Save Windfalls and Bonuses

Utilize Unexpected Money

If you receive a tax refund, bonus, or monetary gift during this period, allocate it entirely to your emergency fund.

Avoid Lifestyle Inflation

Resist the urge to spend windfalls on non-essential items or experiences. Remember, the goal is financial security.

7. Use the 50/30/20 Rule

Adapt Your Budget

Apply the 50/30/20 rule to your income, allocating 50% to needs, 30% to wants, and 20% to savings. During this period, prioritize your emergency fund within the savings category.

Cut Wants Temporarily

If necessary, reduce the “wants” portion to boost your savings rate. Remember, it’s a temporary adjustment for a crucial goal.

8. Avoid Dipping into Savings

Create a Buffer

Ensure your emergency fund remains untouched unless it’s for a genuine emergency. For minor unexpected expenses, use a separate buffer account or cash reserve.

Define Emergencies

Establish clear criteria for what constitutes an emergency to avoid unnecessary withdrawals. Examples include medical expenses, urgent repairs, or job loss.

9. Stay Motivated

Visualize Your Goal

Keep a visual reminder of why you’re building an emergency fund, such as a picture of your family or a list of potential emergencies.

Celebrate Small Wins

Celebrate milestones, like reaching 25%, 50%, or 75% of your goal, to stay encouraged throughout the process.

10. Reevaluate and Adjust if Necessary

Monitor Your Progress

Periodically review your savings plan to ensure you’re on track. Adjust contributions or expenses if needed to meet your six-month deadline.

Prepare for the Future

Once you reach your goal, continue contributing smaller amounts to maintain or grow your fund for long-term security.

Conclusion

Saving for an emergency fund in six months requires discipline, creativity, and a clear plan. By setting specific goals, adjusting your budget, and staying consistent, you can build a financial safety net that protects you from unexpected expenses. Start today, and within half a year, you’ll enjoy peace of mind knowing you’re prepared for whatever life throws your way.

Leave a Reply